HONG KONG: China has become a headache for Western executives. But uprooting supply chains and rejecting the buying power of 1.4 billion people is hard. The good news is that the dilemma need not require drastic action from U.S. and European chief executives, since local Chinese partners could solve the problem by relocating themselves. Tesla’s (TSLA.O) increasing footprint in Mexico is a case in point.

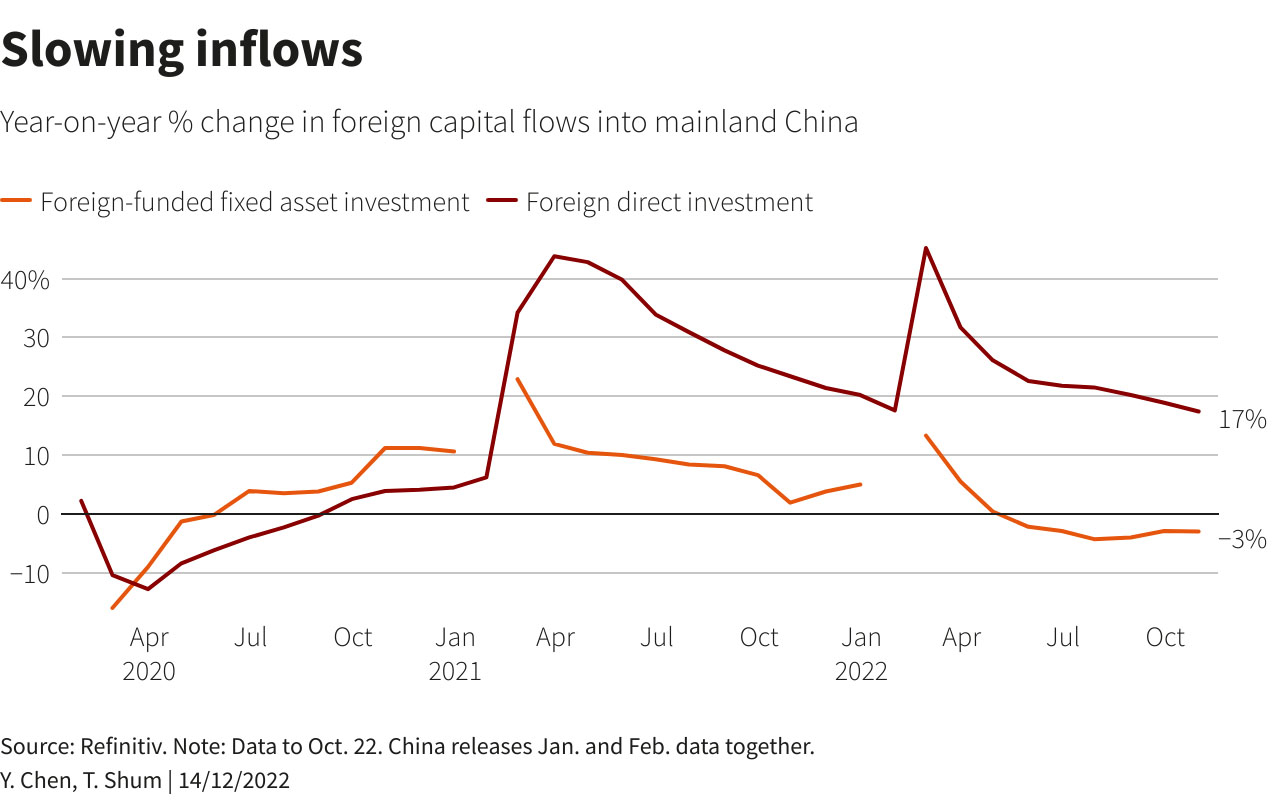

Foreign executives have had a hard time dealing with China’s zero-Covid policy, rising labor costs and U.S. tariffs. Complicating things further is the potential fallout from sanctions if the People's Republic ever invades Taiwan. On the other hand, existing economic interests plus Beijing’s renewed push to attract foreign investment both argue for staying put. China still accounted for a chunky 16% of global foreign direct investment inflows in the first half of 2022, according to the Organization for Economic Co-operation and Development.

Western companies in China overwhelmingly rely on local suppliers, rather than running their own operations on the ground or dealing with other foreign firms. For example, a senior Tesla executive disclosed in August that its Shanghai factory was 95% supplied by domestic producers. Their prominence in the supply chain means local partners could offer Western groups a painless way out of their stay-or-go dilemma. Chinese companies in the mobile, computer and electric-vehicle sectors are increasingly looking to replicate their operations in cheaper, friendlier markets. Building factories elsewhere offers a hedge in case foreign firms quit the People’s Republic. From the Western companies’ point of view, it’s a straightforward way to relocate without rebuilding a supply chain from scratch.

Besides Southeast Asian countries like Vietnam and Eastern European nations such as Hungary, one popular destination is Mexico, where a trade treaty with the United States enables tariff-free exports. As of September, at least 25 Chinese manufacturers that provide parts to Tesla have laid out plans to invest in Mexico, per analysts at Hangzhou-based Zheshang Securities. That includes JL Mag Rare-Earth (300748.SZ), which is investing $100 million in a recycling plant that turns scrapped alloy into permanent magnets.

Beijing may even be able to get behind the trend. A previous instantiation of China’s “going out” policy, initiated at the turn of the century to encourage state champions to venture abroad, was abruptly halted when officials started worrying about capital flight. That’s always a risk. But if Chinese suppliers now start boosting foreign investment to keep hold of key customers, the government may have little choice but to give its blessing.

Reuters